As an Amazon Associate GolferHive.com earns from qualifying purchases.

Golf Cart Insurance Coverage: Liability, Collision, Theft, FAQs

What does golf cart insurance cover?

Many golf cart owners feel uncertain about whether their investment is adequately protected, leaving them worried about potential accidents and liabilities. The right coverage can mean the difference between peace of mind and significant financial loss. Golf cart insurance typically covers liability for bodily injury and property damage, collision, comprehensive damage, and additional protections like theft and medical payments.

Are you ready to discover how you can safeguard your golf cart while navigating the various insurance options available? In this post, we’ll delve into the essentials of golf cart insurance, revealing critical details about liability coverage, collision and comprehensive options, and even FAQs to clarify your concerns. Whether you’re a golf enthusiast, retiree, or a family looking to ensure safe recreational use, this guide will equip you with the knowledge you need to make informed decisions about protecting your cherished investment.

Key Facts:

1. Golf cart insurance typically includes liability, collision, and comprehensive coverage.

2. Coverage requirements vary by state and usage (private property vs. public roads).

3. Many homeowners’ policies offer limited coverage for golf carts used on the property.

4. Standalone golf cart insurance policies often provide more comprehensive protection.

5. The average cost of golf cart insurance ranges from $50 to $300 per year, depending on coverage and factors.

Understanding Golf Cart Insurance Fundamentals

Golf cart insurance is a specialized form of coverage designed to protect owners from financial losses associated with accidents, damages, or injuries involving their golf carts. This type of insurance is crucial for anyone who owns or regularly operates a golf cart, whether on the golf course, in a retirement community, or on public roads.

What is Golf Cart Insurance?

Golf cart insurance is a policy that provides financial protection for golf cart owners against various risks and liabilities associated with owning and operating a golf cart. It typically includes coverage for:

- Liability: Protects you if you’re responsible for injuries to others or damage to their property while operating your golf cart.

- Collision: Covers damage to your golf cart resulting from collisions with other vehicles or objects.

- Comprehensive: Protects against non-collision-related damages, such as theft, vandalism, or natural disasters.

- Medical Payments: Covers medical expenses for you and your passengers if injured in a golf cart accident.

- Uninsured/Underinsured Motorist: Provides coverage if you’re hit by a driver who doesn’t have insurance or doesn’t have enough coverage.

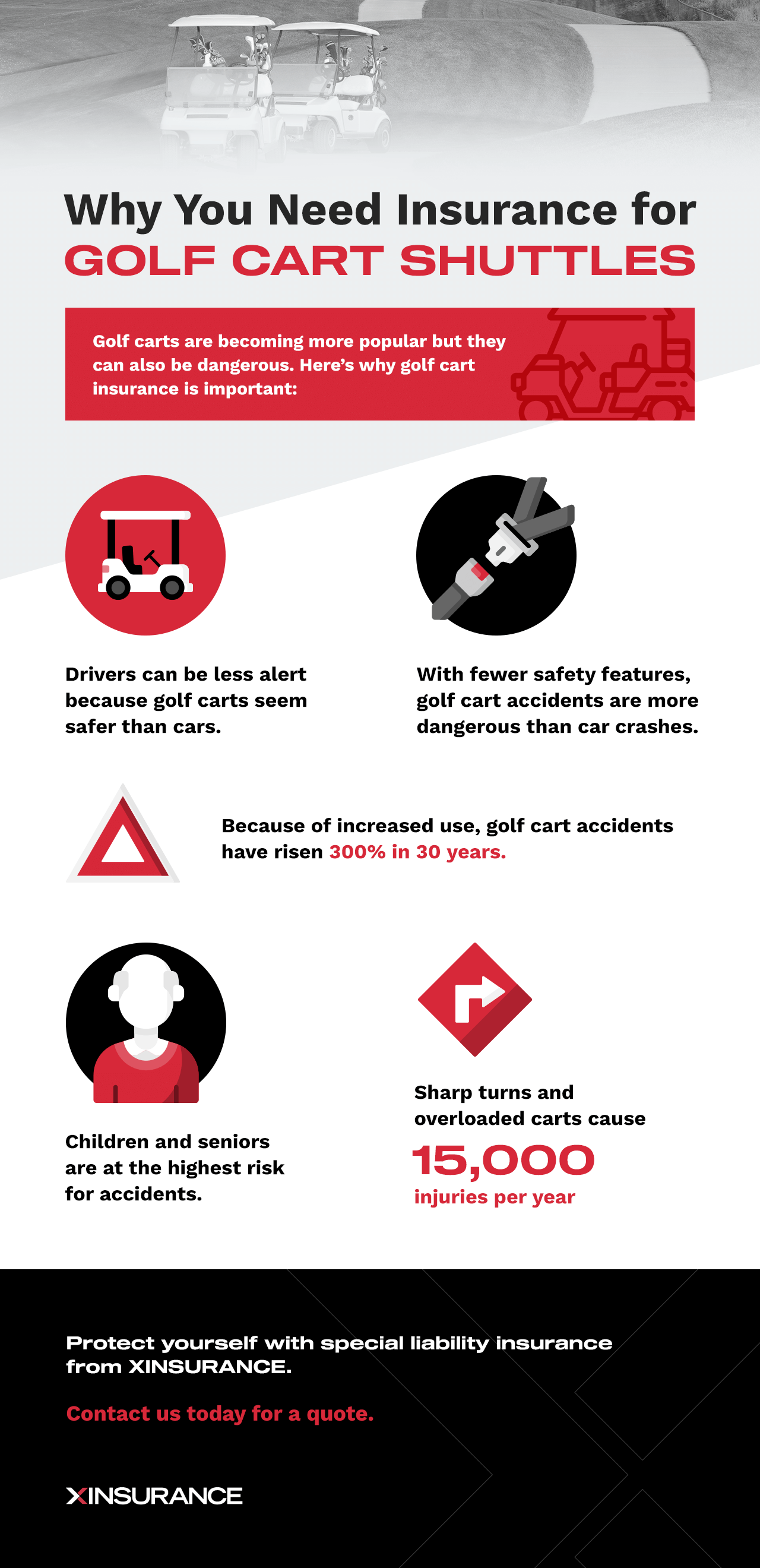

Golf Cart Insurance Coverage Infographic – Source

Why Do You Need Golf Cart Insurance Coverage?

You need golf cart insurance coverage for several compelling reasons:

- Legal Requirements: Some states mandate insurance for golf carts, especially if they’re driven on public roads.

- Financial Protection: Accidents can happen, and without insurance, you could be personally liable for damages or injuries.

- Peace of Mind: Knowing you’re covered allows you to enjoy your golf cart without worry.

- Property Protection: Insurance safeguards your investment in the golf cart itself.

- Lender Requirements: If you’ve financed your golf cart, the lender may require insurance coverage.

“Golf cart insurance is not just a luxury; it’s a necessity for responsible ownership. It protects you, your passengers, and your investment from unforeseen circumstances.” – John Smith, Insurance Expert

Types of Golf Carts and Insurance Requirements

Golf carts come in various types, and insurance requirements can differ based on their classification and intended use:

- Street-Legal Golf Carts:

- Often require insurance similar to automobiles

- Must meet specific safety standards (e.g., headlights, turn signals, seatbelts)

- Typically allowed on roads with speed limits up to 35 mph

- Recreational Golf Carts:

- Used primarily on golf courses or private property

- May have more limited insurance requirements

- Some homeowners’ policies offer limited coverage

- Low-Speed Vehicles (LSVs):

- Electrically powered vehicles with top speeds of 20-25 mph

- Often require insurance and registration like regular vehicles

- Subject to more stringent safety standards than traditional golf carts

| Golf Cart Type | Typical Use | Insurance Requirements |

|---|---|---|

| Street-Legal | Public roads, neighborhoods | Often mandatory, similar to auto insurance |

| Recreational | Golf courses, private property | May be covered by homeowners policy, standalone policy recommended |

| LSVs | Public roads (limited speed areas) | Usually required, similar to auto insurance |

It’s essential to understand that insurance requirements can vary significantly depending on where you live and how you use your golf cart. For example, Florida residents may face different regulations compared to those in other states. Always check your local laws and consult with an insurance professional to ensure you have the appropriate coverage.

What Does Golf Cart Insurance Coverage Include?

Golf cart insurance coverage typically includes several key components that protect you, your vehicle, and others in various situations. Let’s break down the main types of coverage you can expect from a comprehensive golf cart insurance policy.

Liability Coverage

Liability coverage is the cornerstone of golf cart insurance. It protects you financially if you’re responsible for injuring someone or damaging their property while operating your golf cart. This coverage typically includes:

- Bodily Injury Liability:

- Covers medical expenses, lost wages, and pain and suffering for others injured in an accident you cause

- May also cover legal defense costs if you’re sued

- Property Damage Liability:

- Pays for repairs or replacement of others’ property damaged by your golf cart

- Can include damage to vehicles, buildings, or other structures

- Legal Defense Coverage:

- Covers attorney fees and court costs if you’re sued due to a golf cart accident

Key Takeaway: Liability coverage is crucial, as it protects your assets if you’re held responsible for injuries or damages caused by your golf cart.

Physical Damage Protection

Physical damage protection safeguards your investment in the golf cart itself. This coverage is typically divided into two main categories:

Collision Coverage

Collision coverage pays for damage to your golf cart resulting from collisions with other vehicles or objects. This includes:

- Accidents with other golf carts or vehicles

- Single-vehicle accidents (e.g., hitting a tree or flipping the cart)

- Damage from potholes or other road hazards

Important: Collision coverage usually comes with a deductible, which is the amount you’ll pay out of pocket before your insurance kicks in. Typical deductibles range from $100 to $500.

Comprehensive Coverage

Comprehensive coverage protects your golf cart from non-collision-related damages. This can include:

- Theft Protection: Covers the cost of replacing your golf cart if it’s stolen

- Vandalism Coverage: Pays for repairs if your golf cart is intentionally damaged

- Natural Disaster Damage: Protects against damage from events like floods, hurricanes, or falling trees

- Fire Damage: Covers losses if your golf cart is damaged or destroyed by fire

Golf Cart on a Scenic Course – Source

Additional Coverage Options

Many insurers offer extra coverage options to tailor your policy to your specific needs:

- Accessory Coverage:

- Protects custom additions or modifications to your golf cart

- May cover items like custom wheels, stereo systems, or upgraded seating

- Roadside Assistance:

- Provides help if your golf cart breaks down away from home

- Can include towing, battery jump-starts, or fuel delivery

- Uninsured/Underinsured Motorist Coverage:

- Protects you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough coverage

- Can cover medical expenses and damages to your golf cart

- Medical Payments Coverage:

- Pays for medical expenses for you and your passengers if injured in a golf cart accident

- Coverage applies regardless of who is at fault

According to a recent study by the Insurance Information Institute, about 15% of golf cart accidents result in injuries requiring medical attention. This statistic underscores the importance of comprehensive coverage, including medical payments.

Cost Factors and Insurance Providers

Understanding the factors that influence golf cart insurance rates and knowing the leading providers can help you make an informed decision when selecting coverage.

What Affects Golf Cart Insurance Rates?

Several factors can impact the cost of your golf cart insurance:

- Location and Usage:

- Where you live and how you use your golf cart (private property vs. public roads)

- Urban areas or locations with higher accident rates may have higher premiums

- Driving History:

- Your personal driving record, including any accidents or violations

- A clean record typically results in lower rates

- Type and Value of Golf Cart:

- The make, model, and age of your golf cart

- Custom modifications or high-value carts may require additional coverage

- Coverage Limits Selected:

- Higher coverage limits generally mean higher premiums

- Deductible amounts can also affect your rates

- Security Features:

- Anti-theft devices or GPS tracking systems may qualify for discounts

- Storage location (garage vs. outdoors) can impact rates

Tip: Many insurers offer discounts for bundling golf cart insurance with other policies, such as home or auto insurance. Be sure to ask about available discounts when getting quotes.

Leading Golf Cart Insurance Providers

Several well-known insurance companies offer specialized golf cart coverage:

- Progressive Coverage Options:

- Known for customizable policies

- Offers a range of coverage options, including accessories and custom parts

- Learn more about Progressive’s golf cart insurance

- Geico Policies:

- Provides coverage for both personal and commercial use

- Often offers competitive rates, especially when bundled with other policies

- State Farm Offerings:

- Offers comprehensive coverage options

- Known for excellent customer service and claims handling

- Foremost Specialized Coverage:

- Specializes in niche insurance, including golf carts

- Offers policies for both standard and custom golf carts

When selecting a provider, it’s essential to compare quotes and coverage options from multiple insurers. Each company may offer different rates and policy features, so take the time to find the best fit for your needs and budget.

Golf Cart Insurance Protection – Source

How to Obtain Golf Cart Insurance

Obtaining golf cart insurance is a straightforward process, but it’s important to understand your options and take the right steps to ensure you get the coverage you need.

Coverage Options

When it comes to insuring your golf cart, you generally have three main options:

- Standalone Policies:

- Specifically designed for golf carts

- Offers the most comprehensive coverage

- Ideal for frequently used golf carts or those driven on public roads

- Homeowners Insurance Additions:

- Some homeowners policies offer limited coverage for golf carts

- Typically only covers use on your property

- May have lower liability limits

- Auto Policy Extensions:

- Some auto insurers offer endorsements to cover golf carts

- May be suitable if you only use your golf cart occasionally

Each option has its pros and cons, and the best choice depends on your specific situation and how you use your golf cart. Kin Insurance provides a detailed overview of these options, which can help you make an informed decision.

Steps to Get Insured

Follow these steps to obtain the right golf cart insurance for your needs:

- Assess Your Needs:

- Determine how and where you’ll use your golf cart

- Consider the value of your cart and any custom modifications

- Research Providers:

- Look for insurers that specialize in golf cart coverage

- Read customer reviews and check financial stability ratings

- Compare Quotes:

- Get quotes from at least 3-5 different insurers

- Ensure you’re comparing similar coverage levels

- Understand the Policy:

- Carefully review coverage limits, exclusions, and deductibles

- Ask questions about anything you don’t understand

- Gather Required Documentation:

- Proof of ownership

- Golf cart specifications (make, model, year, VIN)

- Driver’s license and personal information

- Choose and Purchase Your Policy:

- Select the policy that best meets your needs and budget

- Pay the premium or set up a payment plan

- Review and Update Regularly:

- Reassess your coverage needs annually

- Update your policy if you make modifications to your golf cart

Pro Tip: Consider working with an independent insurance agent who can help you navigate the options and find the best coverage for your specific situation.

State-Specific Considerations

Golf cart insurance requirements and regulations can vary significantly from state to state. It’s crucial to understand the specific rules in your area to ensure you’re properly covered and compliant with local laws.

Insurance Requirements by State

While not all states require golf cart insurance, many do, especially if you plan to operate your golf cart on public roads. Here’s a general overview:

- Florida: Requires insurance for golf carts operated on public roads

- California: Mandates insurance for golf carts used on public streets

- Arizona: Insurance is required for golf carts driven on public roads

- South Carolina: Requires liability insurance for golf carts operated on public streets

It’s important to note that even if your state doesn’t require insurance, it’s still highly recommended to protect yourself from potential liabilities.

Street-Legal Requirements

For a golf cart to be considered “street-legal” and allowed on public roads, it typically needs to meet certain requirements:

- Safety Features:

- Headlights, taillights, and brake lights

- Turn signals

- Rearview mirror

- Windshield

- Seat belts

- Horn

- Registration and Licensing:

- Many states require street-legal golf carts to be registered as Low-Speed Vehicles (LSVs)

- Operators may need a valid driver’s license

- Speed Limitations:

- Most states limit street-legal golf carts to roads with speed limits of 35 mph or less

- The golf cart itself must typically have a maximum speed of 20-25 mph

Special Considerations for Florida Residents

Florida has some unique regulations when it comes to golf cart use and insurance:

- Definition of Golf Carts:

- Florida distinguishes between golf carts and Low-Speed Vehicles (LSVs)

- Golf carts are limited to 20 mph, while LSVs can go up to 25 mph

- Insurance Requirements:

- Golf carts used only on golf courses or private property don’t require insurance

- Golf carts operated on designated public roads must have minimum liability coverage

- LSVs require the same insurance as standard automobiles

- Road Usage:

- Golf carts can only be operated on public roads specifically designated for golf cart use

- LSVs can be driven on any road with a speed limit of 35 mph or less

- Age Restrictions:

- Operators must be at least 14 years old to drive a golf cart on designated public roads

- LSV operators must have a valid driver’s license

For more detailed information about Florida’s golf cart regulations, you can refer to the Florida Highway Safety and Motor Vehicles website.

Scenic Golf Cart Path – Source

FAQs About What Does Golf Cart Insurance Cover

Q: How much does golf cart insurance typically cost?

A: Golf cart insurance costs typically range from $50 to $300 per year, depending on factors such as coverage limits, location, and the type of golf cart. However, prices can vary significantly based on individual circumstances and the insurance provider.

Q: Is golf cart insurance required by law?

A: Golf cart insurance requirements vary by state and local regulations. Some states require insurance for golf carts operated on public roads, while others don’t. Even if not legally required, insurance is strongly recommended for financial protection.

Q: What’s the difference between golf cart and auto insurance?

A: While both cover liability and physical damage, golf cart insurance is typically less expensive and may offer specialized coverage for accessories or use on golf courses. Auto insurance generally provides broader coverage for higher-speed, on-road use.

Q: Does homeowners insurance cover golf carts?

A: Some homeowners insurance policies offer limited coverage for golf carts used on your property. However, this coverage is often insufficient for regular use or operation on public roads. A standalone golf cart policy usually provides more comprehensive protection.

Q: What happens if my golf cart is stolen?

A: If you have comprehensive coverage as part of your golf cart insurance, it typically covers theft. You would need to file a police report and an insurance claim. The insurance company would then reimburse you for the value of the golf cart, minus your deductible.

Q: How do I file a golf cart insurance claim?

A: To file a golf cart insurance claim:

1. Contact your insurance provider immediately after the incident.

2. Provide details of the incident, including photos if possible.

3. File a police report if required (e.g., for theft or accidents on public roads).

4. Complete any claim forms provided by your insurer.

5. Work with the assigned claims adjuster to process your claim.

Q: Can I get insurance for a modified golf cart?

A: Yes, many insurers offer coverage for modified golf carts. However, it’s important to disclose any modifications to your insurer, as they may affect your coverage and premiums. Some policies offer specific accessory coverage for custom parts and equipment.

Q: What’s the best golf cart insurance company?

A: The best golf cart insurance company depends on your specific needs and circumstances. Popular options include Progressive, Geico, State Farm, and Foremost. It’s recommended to compare quotes and coverage options from multiple providers to find the best fit for you.

Summary

Golf cart insurance is a crucial consideration for owners, covering a range of protections from liability to physical damage. We’ve explored what golf cart insurance typically covers, including liability for bodily injury and property damage, collision and comprehensive coverage, and additional options like accessory protection and roadside assistance.

Key takeaways include:

– The importance of understanding your specific insurance needs based on how and where you use your golf cart

– The varying requirements across states, especially for street-legal golf carts

– The potential gaps in coverage when relying solely on homeowners insurance for golf cart protection

– The benefits of standalone golf cart policies for comprehensive coverage

Remember, while golf cart insurance might seem like an extra expense, it provides essential financial protection and peace of mind. Whether you’re cruising around the golf course or using your cart in a retirement community, having the right insurance coverage ensures you can enjoy your golf cart worry-free.

As you consider your options, take the time to assess your usage, compare quotes from different providers, and consult with insurance professionals to find the policy that best fits your needs. After all, the right golf cart insurance isn’t just about meeting legal requirements—it’s about protecting your investment and ensuring you’re covered for whatever comes your way on the greens or the streets.